Market neutral investing in a new regime

来源:BlackRock

Key points

• As macroeconomic uncertainty persists, investors may want to consider complementing traditional asset classes with additional sources of diversification and return.

• Market neutral strategies may help to improve portfolio outcomes by expanding the investment opportunity set, taking advantage of heightened security dispersion, and providing a diversifying return stream with a low correlation to broad asset classes.

• Systematic processes may maximize the effectiveness of market neutral investing—enabling a granular and nimble approach to investment analysis and implementation.

Macroeconomic uncertainty has remained front and center in 2023 as the new investment regime continues to play out. Inflation remains above central bank targets and some signs of economic weakness have started to surface in the wake of rapid monetary tightening. The dynamics of stable growth, low rates, and low inflation that persisted in recent decades are now working in reverse, creating a new era of increased market volatility.

The previous macroeconomic regime known as the Great Moderation generally supported stable returns and reliably low correlations between stocks and bonds—making the traditional 60/40 allocation1 an ideal asset mix for many investors. Now, investors may need to rethink portfolio construction by complementing traditional asset classes with new sources of diversification and return. While there’s no one-size-fits-all solution, market neutral strategies may help to improve portfolio outcomes by offering a diversifying return stream with a low correlation to broad asset classes.

What is market neutral investing?

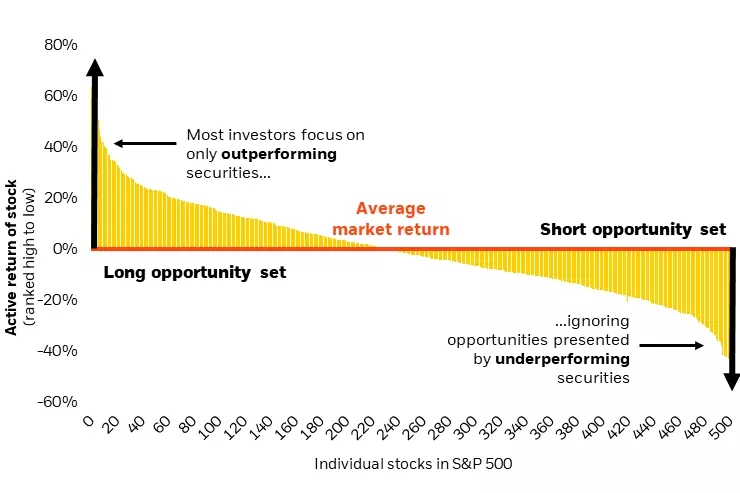

As the name suggests, market neutral strategies are designed to target returns that are independent of market direction. Compared to active long-only strategies that invest only in the highest conviction stocks and avoid those with a less favorable outlook, market neutral strategies are able to make both long and short investments.2 As shown in Figure 1, this expands the opportunity set for return generation, allowing investors to express a broader range of active views (positive, less positive, or negative) across each stock in the investment universe.

Figure 1: Market neutral investing expands the investment opportunity set

Example opportunity set for a market neutral strategy

Source: BlackRock Systematic, as of May 2023.

A relatively even split of long and short investments results in a net market exposure of zero. This greatly reduces the influence of market fluctuations on the strategy’s returns. Instead, returns are driven by security selection and the ability to effectively forecast the relative return differential between long and short holdings.

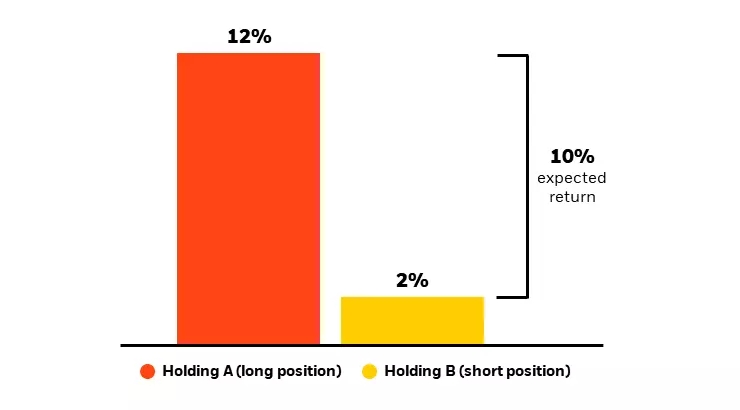

In practice, if the short side of the portfolio lags the long side of the portfolio (in line with forecasts), then those positions will contribute to the strategy’s return potential regardless of market direction. Figure 2 illustrates this concept in the event that markets are trending upwards. If Holding A is projected to increase by 12% and Holding B is projected to increase by 2%, an investor would buy A and short sell B to target an expected return of 10% (before factoring in transaction costs) without exposure to the overall market.

Figure 2: Market neutral returns are driven by security selection across long and short positions, regardless of market direction

Projected returns of a long position (Holding A) and short position (Holding B)

Source: BlackRock Systematic, as of May 2023. For illustrative purposes only.

When are market neutral strategies expected to perform best?

The spread in performance between long and short positions is where the alpha3 opportunity exists for market neutral strategies. This means that the more variation there is in performance across securities, the richer the opportunity set is for return generation.

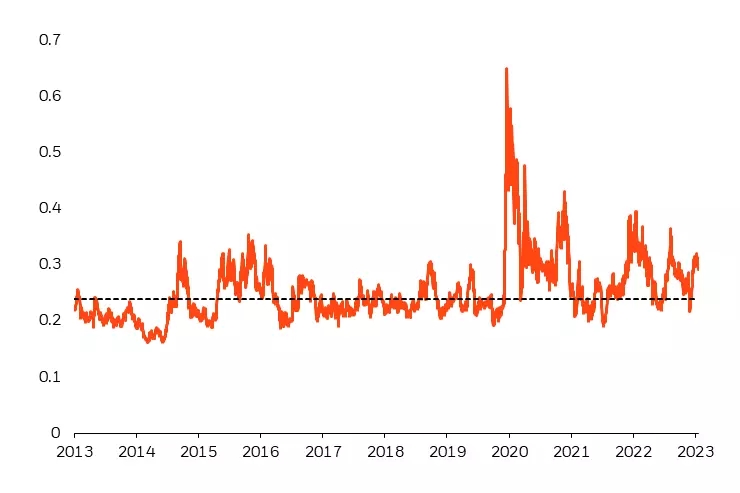

In recent decades, an abundance of central bank liquidity and low borrowing costs supported stable returns for most assets and suppressed security dispersion—or the degree of difference in performance across single securities. Now, macro volatility is creating a more dispersed market environment as individual companies differ in their ability to adapt to challenges like persistent inflation and higher interest rates.

Dispersion is a return source that’s not captured in the traditional 60/40 construct. While stock and bond returns are highly dependent on economic and market conditions, dispersion can exist regardless of market direction. Importantly, it tends to be the highest when markets are volatile and uncertain—the very time that 60/40 portfolios need the most help. Figure 3 shows how equity return dispersion has risen above its historical average. As the previous ‘rising tide lifts all boats’ environment appears to have come to an end, the opportunity to take advantage of the relative return differences across securities makes a market neutral approach increasingly compelling.

Figure 3: Equity return dispersion has risen above its historical average

Cross-sectional standard deviation of trailing 3-month S&P 500 returns

How can market neutral strategies improve portfolio outcomes?

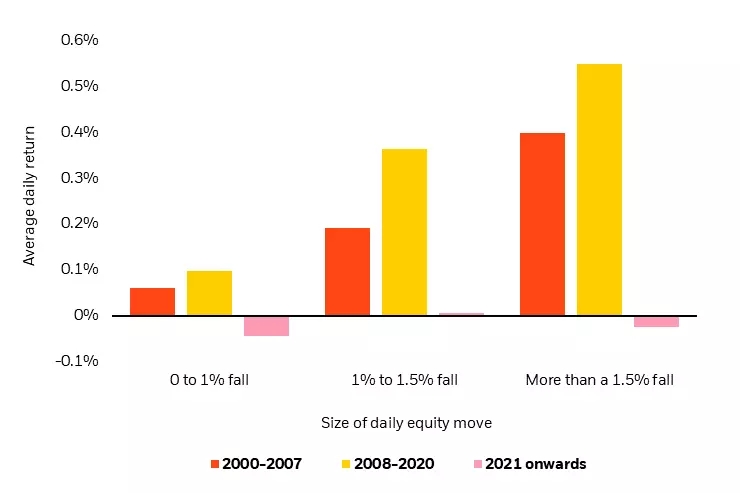

Macro volatility has also shifted the diversification properties of 60/40 portfolios that have been foundational to portfolio construction in recent decades. During the Great Moderation, below target inflation gave central banks the freedom to cut interest rates and ease financial conditions in response to growth shocks. This meant that when stocks would fall, interest rate cuts generally caused bonds to rally and provide a ballast against equity risk.

Now, central banks are limited in their ability to cut interest rates as they prioritize restoring price stability through tighter financial conditions. Figure 4 illustrates how the historically negative correlation between stocks and bonds has become less reliable in a world of high inflation. Over the last two years, bonds have delivered negative returns on average on days when equity returns were also negative.

Figure 4: The ability of bonds to diversify equity risk is less reliable in a world of inflation

10-year US Treasury returns on equity down days, 2000-2023

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, April 2023. Notes: The chart shows the average daily return of 10-year U.S. Treasuries on days when equity prices fell, based on the size of the drop in equity prices. The red bars show daily returns for the period 2000-2007, the yellow bars for the period 2008-2020 and the pink bars for 2021 onwards. All periods start in January and end in December for each respective range. The index used for equities is MSCI World. Past performance is no guarantee of future results.

The degree of diversification that bonds can provide is likely to remain less reliable as the new regime of greater macroeconomic uncertainty persists. By accessing new return sources like security dispersion that are independent of market direction, market neutral strategies tend to exhibit a low correlation to traditional asset classes and even other alternative solutions. This provides the added source of diversification that’s needed in the 60/40 portfolio today.

A systematic approach to market neutral investing

We discussed the potential of market neutral strategies to expand the investment opportunity set, take advantage of new return sources, and provide an added layer of diversification in portfolios. However, not all market neutral strategies are created equal. In our view, a systematic approach helps to maximize the effectiveness of market neutral investing.

Systematic processes enable granular, data-driven analysis to be scaled across the entire breadth of the market every day. Stocks are then scored and ranked daily, combining into a view of the extent that each security is expected to outperform or underperform on a relative basis. The breadth and speed of analysis allows systematic investors to quickly identify alpha opportunities as they arise across the market. Beyond security selection, systematic processes support the rapid recalibration of portfolios that’s necessary to remain nimble in a more volatile regime.

Finally, investment insights are implemented through a process that explicitly balances return considerations with risk and cost tradeoffs. This helps to limit unintended bets or concentration risks that can surface if not closely monitored. The ability to scale investment insights, capture alpha opportunities, and manage risk exposures makes a systematic process well-suited for market neutral investing.

Conclusion

The benefits of market neutral investing have become increasingly relevant amid heightened uncertainty and volatility. As investors look to evolve the traditional 60/40 portfolio to address today’s challenges, market neutral strategies may help target differentiated return sources like security dispersion to complement existing allocations with an additional source of diversification and return. Taking a systematic approach can help to maximize the effectiveness of market neutral investing—providing the breadth, granularity, and speed that’s needed to capture opportunities in the new regime.

Disclaimer: Some of the content on this website is sourced from cooperating media, corporate institutions, information provided by users, and publicly available information on the internet, among others. It is provided for reference purposes only. This website maintains a neutral stance towards the content and viewpoints of all information within the site and does not provide any explicit or implicit guarantees regarding the accuracy, reliability, or completeness of the content. If there are any issues regarding copyright infringement or other concerns, please contact us promptly, and we will handle the content in question in a timely and appropriate manner.